The maximum Social Security benefit can pay up to $54,660 per year at the time of writing. The result is that Social Security benefits are highly case-specific. At the time of writing, they can range from $45 per month at the lowest to $4,555 per month at the highest. You receive the most benefits if you want until the maximum retirement age, currently set at age 70. You get fewer benefits if you collect it early, up to a minimum payment at age 62.

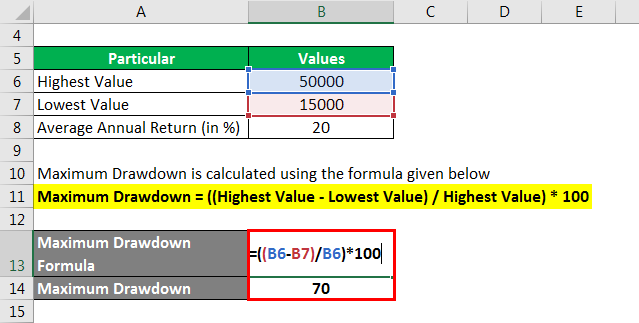

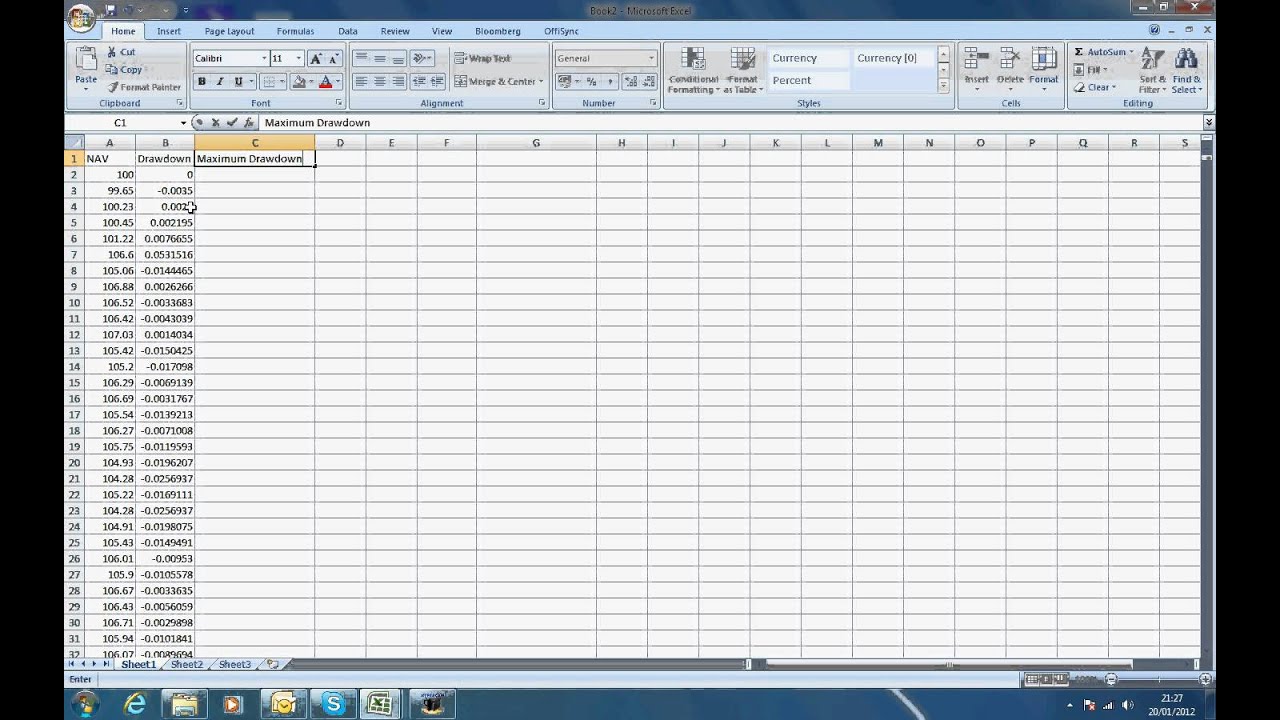

#Return on maximum drawdown full#

You receive full benefits if you begin collecting Social Security at full retirement age, currently set at 67. It also pays more based on the age you begin collecting benefits. The program pays benefits based on how much you paid in Social Security taxes, so wealthier households receive more and poorer households receive less. In general, your personal benefits from Social Security depend on how much you earned during your working life and when you start collecting it. How much you collect from Social Security matters. Where do you want to live? How much does it cost to live there and what will affect those costs over time? How do you want to live? What kind of lifestyle do you want to enjoy and how will those costs change over time?Ĭalculate your retirement needs based on what kind of income you’ll need to meet those goals because how long a retirement account lasts depends on what you take out of it just as much as what you put in. This is a key question for planning out a retirement then. Those numbers change for someone who needs more money and for someone who makes more or less from Social Security. At that rate, a $2 million retirement fund would last, for all intents and purposes, indefinitely. They would only need to draw down an additional $6,000 per year. This alone would net them around $51,000 in perpetual income, money generated without ever touching their portfolio. Say they collect the average Social Security benefit of $20,964 per year and have all of their money invested in bonds, collecting an average yield of $32,000 per year. How long your retirement account will last depends on how much you take out of it and that depends significantly on how and where you live.įor example, take someone who needs nothing more than our median retirement income of $56,800. This probably isn’t enough to live on, but depending on your lifestyle and Social Security benefits it can probably help stretch your retirement savings considerably. If you invested entirely in bonds, your account would generate an additional $32,000 per year. So you would need to feel comfortable sometimes coasting on past withdrawals to let that account regain its value after losses. That’s enough for most households to live on without even dipping into the principal, but in some years that account would take significant losses. If you put your entire portfolio into bonds you can expect average growth of 1.6% per year, but with much less volatility.Ī $2 million retirement account invested entirely in an S&P 500 index fund would return an average of $200,000 per year. If you put your entire portfolio into the S&P 500 you can expect average growth of 10% per year over time, but with bigger dips in the off years. The question of how much, though, depends on how you invest. As you near and enter retirement most people shift this balance away from a higher risk/higher reward assets and into safer investments.Įither way, your portfolio will still generate some money over time. In your working life, your retirement account will often hold a significant measure of equity funds and even, perhaps, some individual stocks. Investors manage their retirement accounts differently over time.

You also get to plan for at least some rate of return. What Is Your Annual Return?īut it’s not that simple (in a good way). With a $2 million retirement account, you can coast on this for about 35 years ($2 million / $56,800). This means that you should plan for your retirement account to replace about 80% of your pre-retirement income.īy those numbers, the median household should plan for around $56,800 per year in replacement income ($71,000 x 0.8).

Most retirement advisors, meanwhile, recommend the 80% rule.

In other words, how much money do you have in your account? How much do you take out of the account each year? And how many years can you make those withdrawals before you run out of money? For a $2 million retirement account, we can start with the averages.Īt the time of writing, the median income in the United States was just below $71,000 according to the U.S.

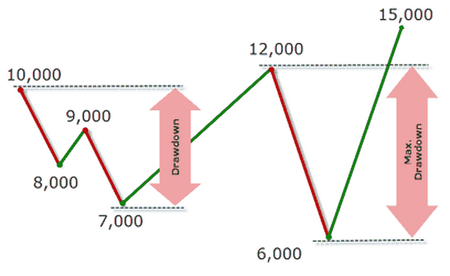

At its most basic, your retirement math is Account – (Drawdown x Year of Retirement).

0 kommentar(er)

0 kommentar(er)